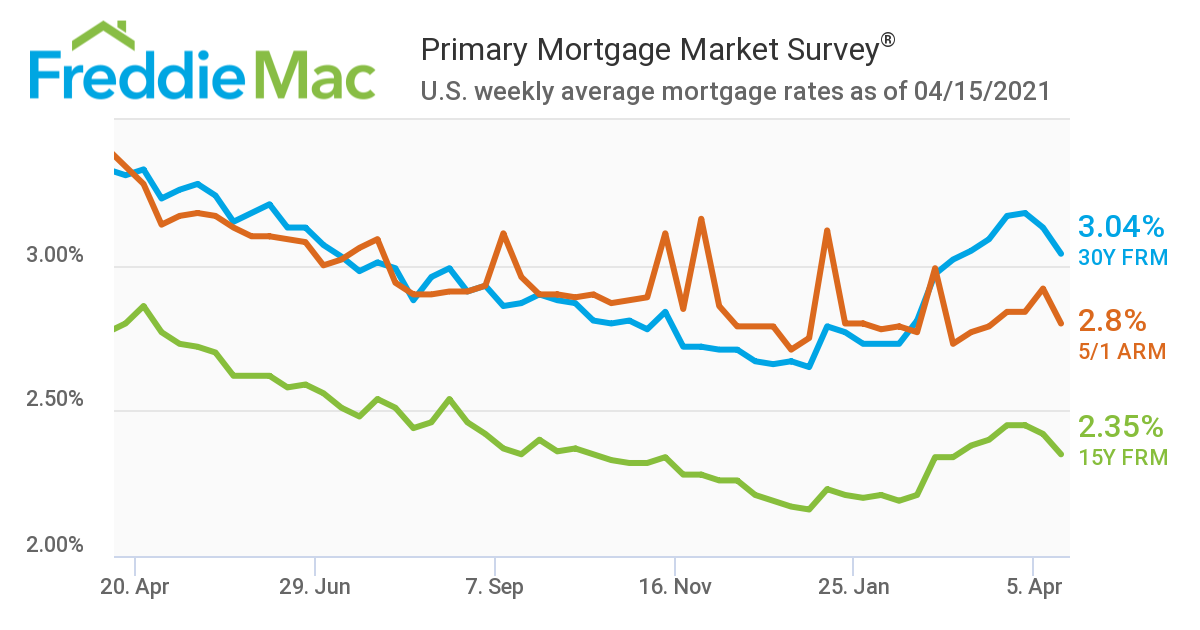

After rising in March, average mortgage

rates started to fall this month. As of

April 15, the average 30-year fixed mortgage rate was 3.04%, according to

Freddie Mac, down from 3.18% two weeks ago.* Today’s rate is also lower than a

year ago, when the average 30-year fixed rate was 3.31%.

The average 15-year mortgage rate

also fell during the last two weeks, from 2.45% to 2.35%. A year ago, the

15-year fixed rate was 2.8%

Low mortgage rates—resulting

in lower monthly payments—act as an incentive for home buyers. The falling

rates are especially welcome now, as buyers contend with low housing inventory

and rising prices.

*Freddie Mac plays an important

role in increasing liquidity and stability in the housing market. It purchases

mortgages from lenders, providing cash for lenders to make additional loans to

home buyers.

Interest rate data and

chart courtesy of Freddie Mac as of April 16, 2021.

You Might Also

Like

Why Buying Before Selling Can Make

Sense

What’s Really Happening in

Montgomery County’s Housing Market

Spotlight on Collegeville

See more of Annette’s articles on

related real estate topics. If you’re planning to buy or sell a

home, contact Annette at (610) 247-7892 or annette@preferredhomes.com

#Realestate #housing #mortgagerates #FreddieMac

Copyright (c) 2021 by Annette Nelson. All

Rights Reserved.