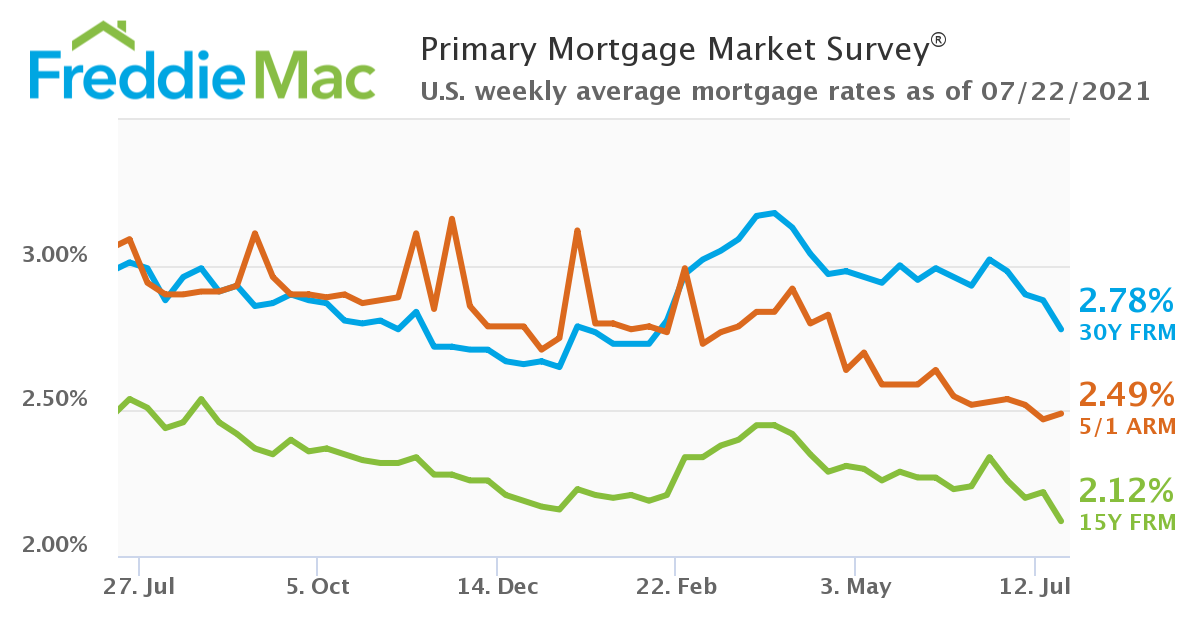

In good news for home buyers, rates for popular mortgages fell

this month. On July 22, the average 30-year fixed rate was 2.78%, down from

2.98% on July 1. The average 15-year rate

was 2.12% on July 22, down from 2.26%, according to Freddie Mac’s Primary

Mortgage Market Survey.*

The decline in mortgage rates occurred

despite economic improvement, reflecting growing concern about the COVID Delta

variant. Low mortgage rates—resulting in lower monthly payments—help home

buyers qualify for higher loans. The falling rates are especially welcome now,

as buyers contend with continued low housing inventory and high prices.

*Freddie Mac plays an important

role in increasing liquidity and stability in the housing market. It purchases

mortgages from lenders, providing cash for lenders to make additional loans to

home buyers.

Data and graph from Freddie Mac,

30-Year Fixed Rate Mortgage Average in the United States, Federal

Reserve Bank of St. Louis, July 24, 2021

You Might Also Like

5 Steps to Avoid Buyer’s Remorse

Why Buying Before Selling Can Make

Sense

Will House Flipping Remain

Popular?

Read more of Annette’s real estate articles

for the latest real estate advice.

FOR EXPERT ADVICE buying or selling a home, contact Annette

Nelson at (610) 247-7892 or annette@preferredhomes.com

#realestate #housing #mortgagerates #Deltavariant

Copyright © 2021 by Annette Nelson.

All Rights Reserved.